Susie Jones

Водители грузовиков призывают к реформе отрасли

Создано: 05.02.2025

•

Обновлено: 05.02.2025

В настоящее время женщины-водители грузовых автомобилей в Великобритании составляют всего 1% от общего числа водителей, и эта цифра увеличилась на 144% за последнее десятилетие по мере внедрения инициатив, направленных на поощрение разнообразия и устранение дефицита водителей.

В статье Fleetpoint рассказывается о многочисленных способах привлечения женщин в отрасль:

Создание благоприятной и гостеприимной рабочей среды.

Модернизация инфраструктуры и удобств.

Гибкие и удобные для семьи условия работы.

Создание четких путей для карьерного роста.

Несмотря на это, водители в [социальных сетях] (https://www.facebook.com/photo/?fbid=988050383364634&set=a.482170237285987&locale=en_GB) утверждали, что эти давние проблемы в отрасли должны быть решены для всех, прежде чем будут выдвинуты новые инициативы по устранению нехватки водителей.

Нехватка водителей - где сейчас находится отрасль?

Нехватка водителей была постоянной проблемой для транспортной отрасли, но после COVID-19 и Brexit она достигла критического уровня. В 2024 году в Европе, Норвегии и Великобритании не хватало более 233 000 водителей грузовиков, а к 2028 году эта цифра превысит 745 000 в связи со старением рабочей силы.

Индустрия все еще борется с последствиями и работает над реализацией новых инициатив, направленных на поощрение многообразия, улучшение условий труда и ликвидацию разрыва в рабочей силе.

Правительство приняло ряд [33](https://www.gov.uk/government/topical-events/hgv-driver-shortage-uk-government-response/about#:~:text=We%20extended%20dangerous%20goods%20(ADR,to%20take%20refresher%20training%20now.) мер для решения проблемы нехватки водителей грузовых автомобилей в Великобритании. В том числе, но не ограничиваясь этим:

Повышение эффективности существующих цепочек поставок.

Оказание поддержки и обучение новых водителей грузовых автомобилей.

Расширение возможностей тестирования водителей грузовых автомобилей.

Совершенствование процессов лицензирования.

Улучшение условий.

Обеспечение стабильности цепочки поставок топлива.

Что нужно изменить? Водители высказывают свое мнение.

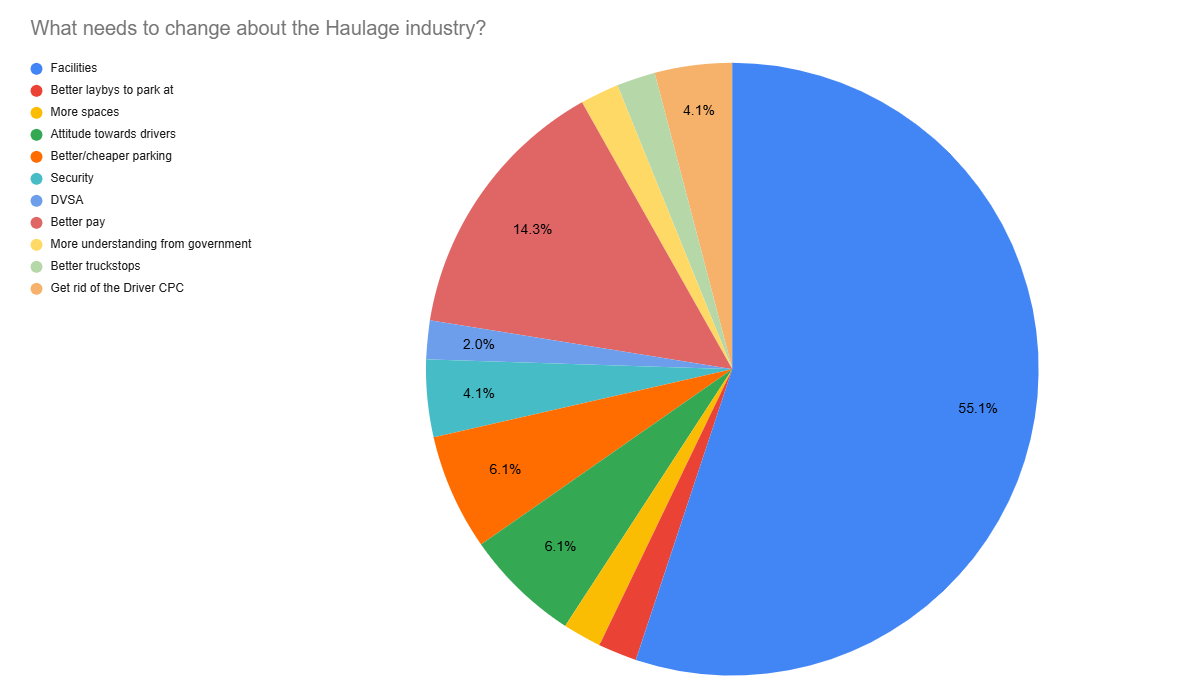

49 % водителей в социальных сетях утверждают, что изменения должны происходить независимо от пола, при этом 27 % женщин-водителей грузовиков согласны с тем, что отрасль должна развиваться для всех. 24 % заявили, что работа больше не привлекает, что подчеркивает необходимость перемен в отрасли. Итак, что же хотят изменить водители?

Объекты

55 % хотели бы, чтобы удобства были улучшены для всех:

"Должны быть лучшие условия и лучшее обращение. Вся индустрия в полном беспорядке, и с нами плохо обращаются".

"Удобства ужасны для всех водителей, мужчин и женщин".

В ноябре 2024 года исследование [Transport Focus] (https://www.britsafe.org/safety-management/2024/uk-truckers-why-more-action-is-needed-to-make-their-working-lives-safer-and-healthier#:~:text=Improving%20roadside%20facilities&text=Drivers%20have%20long%20been%20telling,asked%20expressed%20dissatisfaction%20with%20both.) показало, что две трети водителей не удовлетворены работой автостоянок: грязные помещения, скудный выбор еды и отсутствие социального пространства вызывают серьезные проблемы.

Правительство и индустрия грузоперевозок приняли значительные меры, инвестировав 14 миллионов фунтов стерлингов в развитие инноваций и улучшение условий труда.

В октябре 2024 года 23 успешных претендента получили до 4,5 миллионов фунтов стерлингов на модернизацию своих автостоянок. Модернизация будет включать в себя новые душевые, рестораны и улучшенные средства безопасности, чтобы водители были более спокойны. Кроме того, будет создано около 430 парковочных мест для большегрузных автомобилей.

Оплата

На втором месте в списке стоит повышение зарплаты: 14 % водителей утверждают, что увеличение зарплаты будет способствовать росту числа работников отрасли:

"Сделайте ее привлекательной для всех, повысьте зарплату".

Повышение заработной платы обойдется лидерам отрасли очень дорого. Если бы средняя зарплата водителя грузовика выросла в соответствии с Национальным прожиточным минимумом, операторы автопарков могли бы столкнуться с дополнительной суммой в 1,5 миллиарда фунтов стерлингов в год.

Несмотря на это, инвестиции позволят улучшить показатели удержания, сократить расходы на подбор персонала и снизить стоимость обучения. Предложение более высокой зарплаты не только сделает профессию более привлекательной для новых участников, но и признает важнейшую роль, которую водители играют в поддержании цепочки поставок.

Отношение к водителям

За прошедшие годы общественное мнение о водителях грузовиков значительно изменилось. Жизнь дальнобойщика часто романтизировалась в фильмах и популярных средствах массовой информации, что заставляло многих думать, что им легко живется. Однако при этом их представляли героями-тружениками, образ которых со временем ухудшился.

К концу XX века восприятие изменилось, поскольку условия работы стали тяжелыми, а водители грузовиков получили несправедливые стереотипы - часто из-за искажения информации в СМИ, а иногда из-за неопытности нескольких водителей. Эти негативные стереотипы были смягчены во время пандемии COVID-19, когда общественность стала больше ценить водителей грузовиков.

Сегодня дальнобойщиков уважают, однако отрасль по-прежнему страдает от негативных стереотипов и отношения к ним. 6% водителей хотели бы, чтобы ситуация изменилась:

"Вспоминая Ковид, мы считались героями, но потом все вернулось на круги своя. Неудивительно, что нынешние водители, мужчины и женщины, хотят уйти из отрасли. Они устали от отвратительного обращения, с которым сталкиваются ежедневно".

"Было бы здорово, если бы к тебе не относились как к отбросу".

В последние годы развитие социальных сетей стало опровергать и менять негативные представления. Многие водители выходят на такие платформы, как TikTok и Instagram, чтобы рассказать о своей роли, развеять заблуждения и заслужить уважение со стороны тех, кто не работает в этой отрасли.

Отзывы свидетельствуют о том, что в отрасли грузоперевозок назрела острая необходимость в проведении изменений, направленных на привлечение и удержание существующих и новых водителей. Недопредставленность женщин остается серьезной проблемой, поэтому инвестиции в объекты, отвечающие их потребностям, имеют решающее значение. Однако эти инвестиции должны быть инклюзивными и отвечать интересам всей рабочей силы.

В каких странах ощущается нехватка водителей грузовиков?

Больше всего пострадали страны Европы, где многие автотранспортные компании не могут расширить свой бизнес из-за нехватки квалифицированных работников.

В Европе наблюдается старение населения водителей грузовиков, средний возраст которых составляет 47 лет (https://www.iru.org/news-resources/newsroom/half-european-truck-operators-cant-expand-due-driver-shortages#:~:text=The%20EU%2C%20Norway%20and%20the,an%20average%20age%20of%2047.). Треть дальнобойщиков старше 55 лет, и ожидается, что они выйдут на пенсию в ближайшие десять лет. Кроме того, менее 5 % водителей грузовиков в Европе моложе 25 лет, что подчеркивает пробел, который возникнет после выхода на пенсию стареющей рабочей силы.

Существует ли день благодарности водителям грузовиков?

День благодарности водителям грузовиков [HGV Drivers Day] (https://https://snapacc.com/newsroom/hgv-drivers-day-2025-giving-truckers-a-voice/) проводится 22 января и был учрежден компанией NN1 Personnel. Цель этого дня - отметить водителей грузовиков и все, что они делают для экономики и общества.

Каковы перспективы индустрии грузоперевозок на 2025 год?

Из нашего блога [The Road Ahead for 2025] (https://snapacc.com/newsroom/the-road-ahead-for-2025-truck-industry-trends-to-expect/) мы ожидаем, что в этом году в индустрии грузоперевозок произойдут следующие события:

Использование преимуществ искусственного интеллекта.

Борьба с гендерным неравенством и нехваткой водителей.

Продвижение экологически чистой промышленности.

Увеличение объема междугородних грузоперевозок.