Susie Jones

Řidiči kamionů žádají reformu odvětví

Vytvořeno: 05.02.2025

•

Aktualizováno: 05.02.2025

V současné době tvoří řidičky nákladních vozidel ve Spojeném království pouhé 1 % všech řidičů - toto číslo se za posledních deset let zvýšilo o 144 % s tím, jak bylo zavedeno více iniciativ na podporu rozmanitosti a odstranění nedostatku řidičů.

Článek Fleetpoint popisuje mnoho způsobů, jak by odvětví mohlo přilákat více žen:

Vytváření vstřícného a přívětivého pracovního prostředí.

Modernizace infrastruktury a občanské vybavenosti.

Flexibilní a rodinné pracovní podmínky.

Vytvoření jasných cest pro kariérní růst.

Navzdory tomu řidiči na sociálních sítích tvrdili, že tyto dlouhodobé problémy v odvětví musí být řešeny pro všechny, než budou zavedeny nové iniciativy, které by nedostatek řidičů odstranily.

Nedostatek řidičů - jak je na tom odvětví nyní?

Nedostatek řidičů je pro dopravní průmysl trvalým problémem, ale po konferenci COVID-19 a brexitu dosáhl kritické úrovně. V roce 2024 chybělo v Evropě, Norsku a Spojeném království více než 233 000 řidičů nákladních automobilů - do roku 2028 by tento počet měl v důsledku stárnutí pracovní síly přesáhnout 745 000 řidičů.

Odvětví se stále potýká s důsledky a pracuje na zavádění nových iniciativ na podporu rozmanitosti, zlepšování pracovních podmínek a odstraňování rozdílů v počtu pracovních sil.

Vláda zavedla zhruba [33](https://www.gov.uk/government/topical-events/hgv-driver-shortage-uk-government-response/about#:~:text=We%20extended%20dangerous%20goods%20(ADR,to%20take%20refresher%20training%20now.) opatření k řešení nedostatku řidičů nákladních vozidel ve Spojeném království. Patří mezi ně mj:

Zvýšení efektivity stávajících dodavatelských řetězců.

Poskytování podpory a školení novým řidičům nákladních vozidel.

Rozšíření kapacity pro testování řidičů těžkých nákladních vozidel.

Zlepšení licenčních procesů.

Zlepšení podmínek.

Zajištění stability řetězce dodávek pohonných hmot.

Co je třeba změnit? Řidiči mají svůj názor.

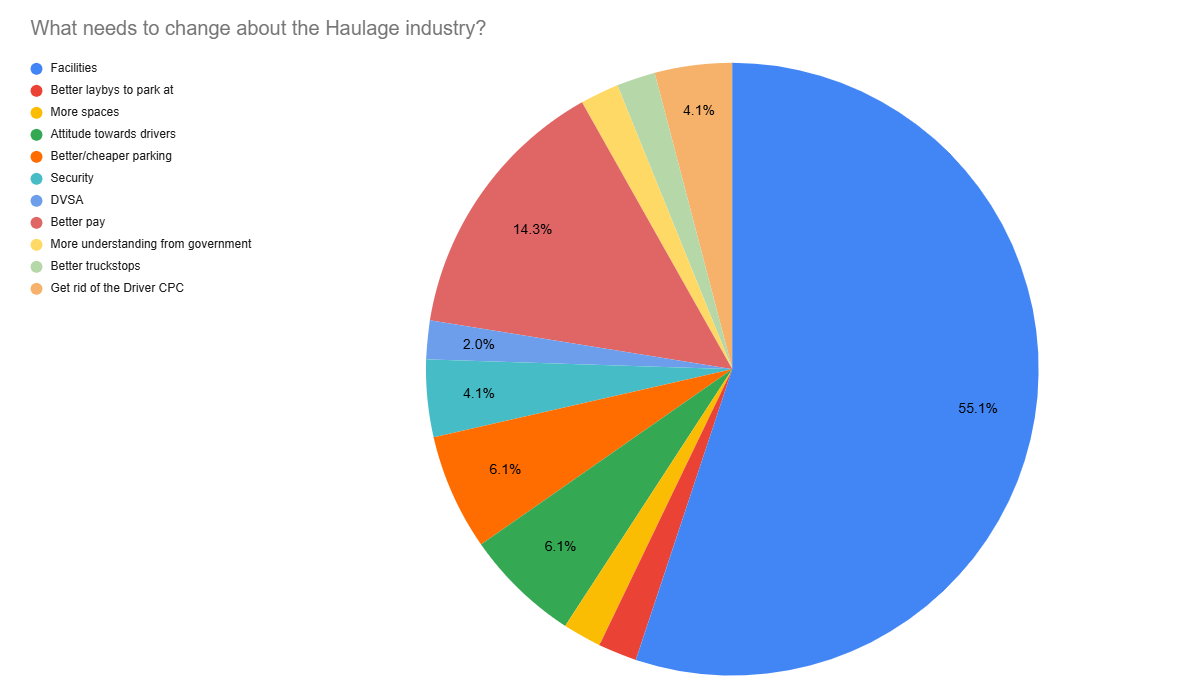

49 % řidičů na sociálních sítích tvrdí, že změny musí být provedeny bez ohledu na pohlaví - 27 % řidičů a řidiček nákladních vozidel souhlasí s tím, že se odvětví musí vyvíjet pro všechny. 24 % uvedlo, že tato práce již není atraktivní, což zdůrazňuje potřebu změn v tomto odvětví. Co si tedy řidiči přejí změnit?

Zařízení

55 % respondentů si přálo, aby se zlepšilo vybavení pro všechny:

"Je třeba lepšího zázemí a lepšího zacházení. Celé odvětví je v troskách a špatně se s námi zachází."

"Vybavení je hrozné pro všechny řidiče, muže i ženy."

Průzkum Transport Focus v listopadu 2024 zjistil, že dvě třetiny řidičů jsou nespokojeny se zařízeními zastávek pro nákladní automobily - značné problémy způsobuje špinavé vybavení, špatné možnosti stravování a nedostatek společenského prostoru.

Vláda a odvětví nákladní dopravy přijaly významná opatření a investovaly 14 milionů liber na podporu inovací a zlepšení pracovních podmínek.

V říjnu 2024 získalo 23 úspěšných žadatelů až 4,5 milionu liber na vylepšení svých zastávek pro kamiony. Modernizace budou zahrnovat nové sprchy, restaurace a vylepšené bezpečnostní prvky, které řidičům poskytnou větší klid. Kromě toho bude v rámci programu vytvořeno přibližně 430 parkovacích míst pro těžká nákladní vozidla.

Pay

Na druhém místě v žebříčku se umístilo lepší odměňování, přičemž 14 % řidičů uvedlo, že zvýšení mezd by přimělo více řidičů k nástupu do odvětví:

"Udělejte ji atraktivní pro všechny, zvyšte mzdy."

Zvyšování mezd bude pro vedoucí pracovníky v odvětví znamenat značné náklady. Pokud by se průměrná mzda řidiče nákladního vozidla zvýšila v souladu s národní mzdou na úrovni životního minima, provozovatelé vozových parků by mohli ročně získat 1,5 miliardy liber navíc.

Přesto investice zlepší míru udržení zaměstnanců, sníží náklady na nábor a náklady na školení. Nabídka vyšších platů by nejen zvýšila atraktivitu profese pro nové zájemce, ale také by uznala klíčovou roli, kterou řidiči hrají při udržování dodavatelského řetězce.

Přístup k řidičům

Názory veřejnosti na řidiče kamionů se v průběhu let výrazně změnily. Život řidičů kamionů je často romantizován ve filmech a populárních médiích - což vede mnohé k přesvědčení, že to mají snadné. Zároveň však byli prezentováni jako tvrdě pracující hrdinové, což je obraz, který se postupem času zhoršil.

Ke konci 20. století se vnímání změnilo, protože pracovní podmínky se staly tvrdšími a řidiči nákladních automobilů se stali terčem nespravedlivých stereotypů - často kvůli zkreslenému obrazu v médiích a někdy i kvůli několika nezkušeným řidičům. Tyto negativní stereotypy se zmírnily během pandemie COVID-19, kdy se zvýšilo uznání veřejnosti pro řidiče kamionů.

V současné době mají řidiči kamionů respekt, nicméně toto odvětví je stále zatíženo negativními stereotypy a postoji. Změnu by si přálo 6 % řidičů:

"Když si vzpomenu na Covid, byli jsme považováni za hrdiny, ale pak se to vrátilo do normálu. Není divu, že současní řidiči, muži i ženy, chtějí z oboru odejít. Už mají dost toho šmejdského zacházení, kterému denně čelí."

"Bylo by hezké, kdyby s vámi nejednali jako s póvlem."

V posledních letech začaly sociální sítě zpochybňovat a měnit negativní vnímání. Mnoho řidičů se na platformách, jako je TikTok a Instagram, dělí o své postřehy, vyvrací mylné představy a získává si respekt lidí mimo obor.

Zpětná vazba ukazuje, že je naléhavě nutné, aby odvětví nákladní dopravy provedlo změny, které by přilákaly a udržely stávající i nové řidiče. Nedostatečné zastoupení žen zůstává významnou výzvou a investice do zařízení, která uspokojí jejich potřeby, jsou klíčové. Tyto investice však musí být inkluzivní a přínosné pro všechny zaměstnance.

Ve kterých zemích je nedostatek řidičů nákladních vozidel?

Nejhůře jsou postiženy země v Evropě, kde mnoho dopravních společností nemůže rozšiřovat své podnikání, protože nemohou najít kvalifikované pracovníky.

V Evropě stárne populace řidičů nákladních automobilů, jejichž průměrný věk je 47 let(https://www.iru.org/news-resources/newsroom/half-european-truck-operators-cant-expand-due-driver-shortages#:~:text=The%20EU%2C%20Norway%20and%20the,an%20average%20age%20of%2047.). Třetina řidičů kamionů je starší 55 let a očekává se, že v příštích deseti letech odejde do důchodu. Kromě toho je méně než 5 % řidičů nákladních automobilů v Evropě mladších 25 let - což poukazuje na mezeru, která vznikne po odchodu stárnoucí pracovní síly do důchodu.

Je nějaký den pro řidiče kamionů?

Den řidičů nákladních vozidel se koná 22. ledna a byl založen společností NN1 Personnel. Cílem tohoto dne je oslavit řidiče nákladních vozidel a vše, co dělají pro ekonomiku a společnost.

Jaký je výhled odvětví nákladní dopravy pro rok 2025?

Z našeho blogu The Road Ahead for 2025 vyplývá, že v tomto roce budou v odvětví nákladní dopravy vystupovat do popředí následující skutečnosti:

Využití výhod umělé inteligence.

Řešení rozdílů mezi pohlavími a nedostatku řidičů.

Podpora ekologičtějšího průmyslu.

Zvyšování objemu dálkové nákladní dopravy.