Susie Jones

Los camioneros piden una reforma del sector

Creado: 05/02/2025

•

Actualizado: 05/02/2025

Actualmente, las mujeres conductoras de camiones en el Reino Unido representan sólo el 1% de todos los conductores, una cifra que ha aumentado un 144% en la última década a medida que se introducen más iniciativas para promover la diversidad y cerrar la brecha de escasez de conductores.

Un artículo de Fleetpoint describe las muchas formas en que el sector podría atraer a más mujeres a la industria:

Cultivar un entorno de trabajo solidario y acogedor.

Mejora de las infraestructuras y los servicios.

Modalidades de trabajo flexibles y favorables a la familia.

Crear vías claras para el crecimiento profesional.

A pesar de ello, los conductores de medios de comunicación social argumentaron que estos retos de larga data en la industria deben ser abordados para todos antes de que se traigan nuevas iniciativas para cerrar la escasez de conductores.

Escasez de conductores: ¿dónde está ahora el sector?

La escasez de conductores ha sido un problema persistente para la industria del transporte, pero tras la COVID-19 y el Brexit, alcanzó niveles críticos. En 2024, Europa, Noruega y el Reino Unido carecían de más de 233.000 conductores de camión, una cifra que superará los 745.000 en 2028 debido al envejecimiento de la mano de obra.

El sector sigue lidiando con las consecuencias y trabaja para poner en marcha nuevas iniciativas que fomenten la diversidad, mejoren las condiciones de trabajo y reduzcan las diferencias de mano de obra.

El Gobierno ha puesto en marcha unas [33](https://www.gov.uk/government/topical-events/hgv-driver-shortage-uk-government-response/about#:~:text=We%20extended%20dangerous%20goods%20(ADR,to%20take%20refresher%20training%20now.) acciones para hacer frente a la escasez de conductores de vehículos pesados en el Reino Unido. Entre ellas se incluyen

Aumentar la eficiencia de las cadenas de suministro existentes.

Proporcionar apoyo y formación a los nuevos conductores de vehículos pesados.

Ampliación de la capacidad de examen de los conductores de vehículos pesados.

Mejora de los procesos de concesión de licencias.

Mejora de las condiciones.

Garantizar la estabilidad de la cadena de suministro de combustible.

¿Qué hay que cambiar? Los conductores opinan.

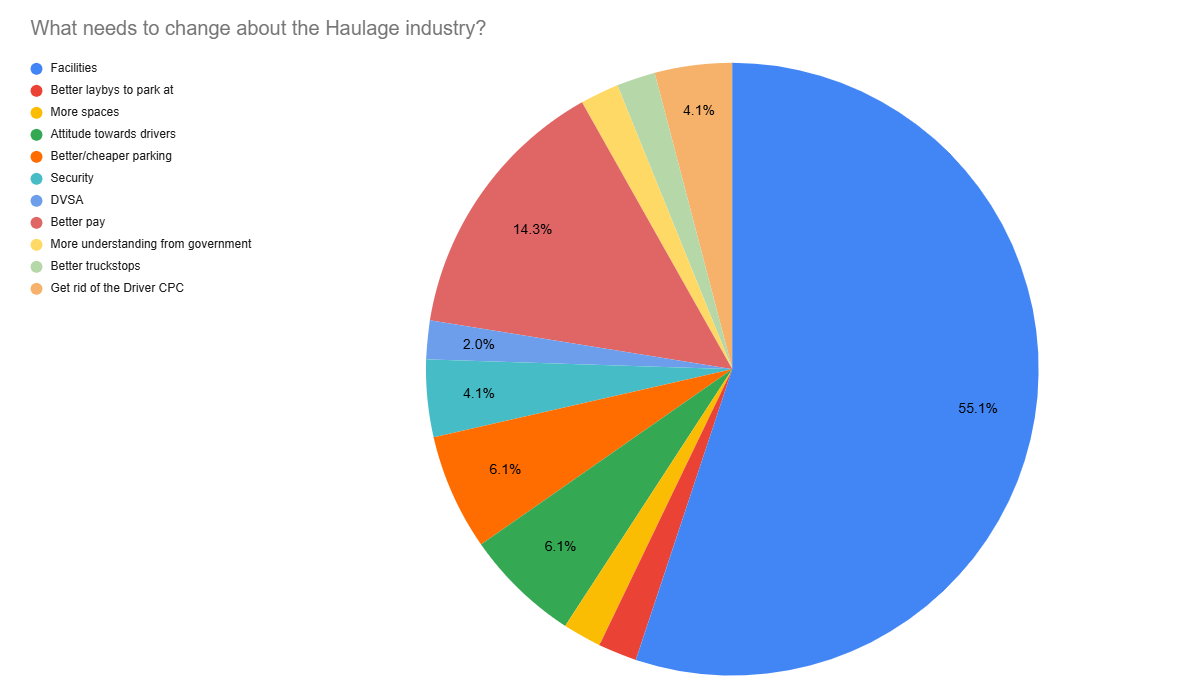

El 49% de los conductores en las redes sociales afirmaron que los cambios deben aplicarse con independencia del género, y el 27% de las conductoras de camiones estuvieron de acuerdo en que el sector debe evolucionar para todos. El 24% afirma que el trabajo ya no es atractivo, lo que pone de manifiesto la necesidad de cambios en el sector. Entonces, ¿qué quieren los conductores que cambie?

Instalaciones

El 55% desea que se mejoren las instalaciones para todos:

"Tiene que haber mejores instalaciones y mejor trato y punto. Todo el sector es un caos y nos maltratan".

"Las comodidades son pésimas para todos los conductores, hombres y mujeres".

En noviembre de 2024, una encuesta de Transport Focus (https://www.britsafe.org/safety-management/2024/uk-truckers-why-more-action-is-needed-to-make-their-working-lives-safer-and-healthier#:~:text=Improving%20roadside%20facilities&text=Drivers%20have%20long%20been%20telling,asked%20expressed%20dissatisfaction%20with%20both.) reveló que dos tercios de los conductores estaban insatisfechos con las instalaciones de las paradas de camiones: la suciedad, la escasez de comida y la falta de espacio social eran los principales problemas.

El Gobierno y el sector del transporte han adoptado importantes medidas invirtiendo 14 millones de libras para impulsar la innovación y mejorar las condiciones de trabajo.

En octubre de 2024, 23 candidatos seleccionados recibieron hasta 4,5 millones de libras para mejorar sus paradas de camiones. Las mejoras incluirán nuevas duchas, restaurantes y dispositivos de seguridad mejorados para mayor tranquilidad de los conductores. Además, se crearán unas 430 plazas de aparcamiento para vehículos pesados.

Pay

La mejora salarial ocupa el segundo lugar de la lista, con un 14% de los conductores que afirman que un aumento salarial animaría a más personas a entrar en el sector:

"Hacerlo atractivo para todos, aumentar los salarios".

Aumentar los salarios tendrá un coste significativo para los líderes del sector. Si el salario medio de un conductor de camión aumentara en consonancia con el salario digno nacional, los operadores de flotas podrían tener que hacer frente a 1.500 millones de libras adicionales al año.

A pesar de ello, la inversión mejorará los índices de retención, reducirá los gastos de contratación y disminuirá los costes de formación. Ofrecer salarios más elevados no sólo haría la profesión más atractiva para los recién llegados, sino que también reconocería el papel fundamental que desempeñan los conductores en el mantenimiento de la cadena de suministro.

Actitud hacia los conductores

A lo largo de los años, la opinión pública sobre los camioneros ha evolucionado mucho. Las películas y los medios de comunicación han idealizado a menudo la vida de los camioneros, haciéndoles creer que lo tienen fácil. Sin embargo, también se les presentaba como héroes trabajadores, una imagen que se ha deteriorado con el tiempo.

Hacia finales del siglo XX, las percepciones cambiaron a medida que las condiciones de trabajo se endurecían y los camioneros eran objeto de estereotipos injustos, a menudo debido a la tergiversación de los medios de comunicación y, en ocasiones, a unos pocos conductores inexpertos. Estos estereotipos negativos se atenuaron durante la pandemia de COVID-19, cuando creció el aprecio público por los camioneros.

Hoy en día se respeta a los camioneros, pero el sector sigue plagado de estereotipos y actitudes negativas. Algo de lo que el 6% de los conductores desea que cambie:

"Recordando Covid, se nos consideraba héroes, pero después todo volvió a la normalidad. No es de extrañar que los conductores actuales, hombres y mujeres, quieran abandonar el sector. Están hartos del trato basura al que se enfrentan a diario".

"Estaría bien que no te trataran como si fueras escoria".

En los últimos años, el auge de las redes sociales ha empezado a cuestionar y cambiar las percepciones negativas. Muchos conductores utilizan plataformas como TikTok e Instagram para compartir información sobre su trabajo, disipar ideas erróneas y ganarse el respeto de quienes no pertenecen al sector.

Los comentarios recibidos muestran la urgente necesidad de que el sector del transporte introduzca cambios para atraer y retener a los conductores actuales y a los nuevos. La infrarrepresentación de las mujeres sigue siendo un reto importante, por lo que es crucial invertir en instalaciones que atiendan sus necesidades. Sin embargo, esta inversión debe ser inclusiva y beneficiar a toda la plantilla.

¿Qué países sufren escasez de camioneros?

Los países europeos son los más afectados: muchas empresas de transporte no pueden ampliar su negocio porque no encuentran trabajadores cualificados.

Europa tiene una población de camioneros envejecida, con una edad media de 47 años. Un tercio de los camioneros tiene más de 55 años y se espera que se jubile en los próximos diez años. Además, menos del 5% de los camioneros europeos tienen menos de 25 años, lo que pone de manifiesto el vacío que quedará una vez que se haya jubilado una mano de obra que envejece.

¿Existe un día de agradecimiento al conductor de camión?

El HGV Drivers Day tiene lugar el 22 de enero y fue establecido por NN1 Personnel. El día pretende celebrar a los camioneros y todo lo que hacen por la economía y la sociedad.

¿Cuáles son las perspectivas del sector del transporte por carretera para 2025?

De nuestro blog, The Road Ahead for 2025, esperamos que este año destaque lo siguiente en el sector del transporte por carretera:

Aprovechar las ventajas de la IA.

Afrontar la brecha de género y la escasez de conductores.

Fomentar una industria más ecológica.

Aumento del transporte de mercancías de larga distancia.