Guest

Fuel vs charge: Is the switch to electric cheaper or just greener?

Created: 28/07/2025

•

Updated: 19/09/2025

The growth of electric charging stations across Europe for HGVs has led to a transitional period across the continent's vast road networks. For many fleet operators and drivers, classic diesel-fuelled HGVs are still the transport of choice. However, the shift to electric HGVs is looming, as the industry continues to evolve.

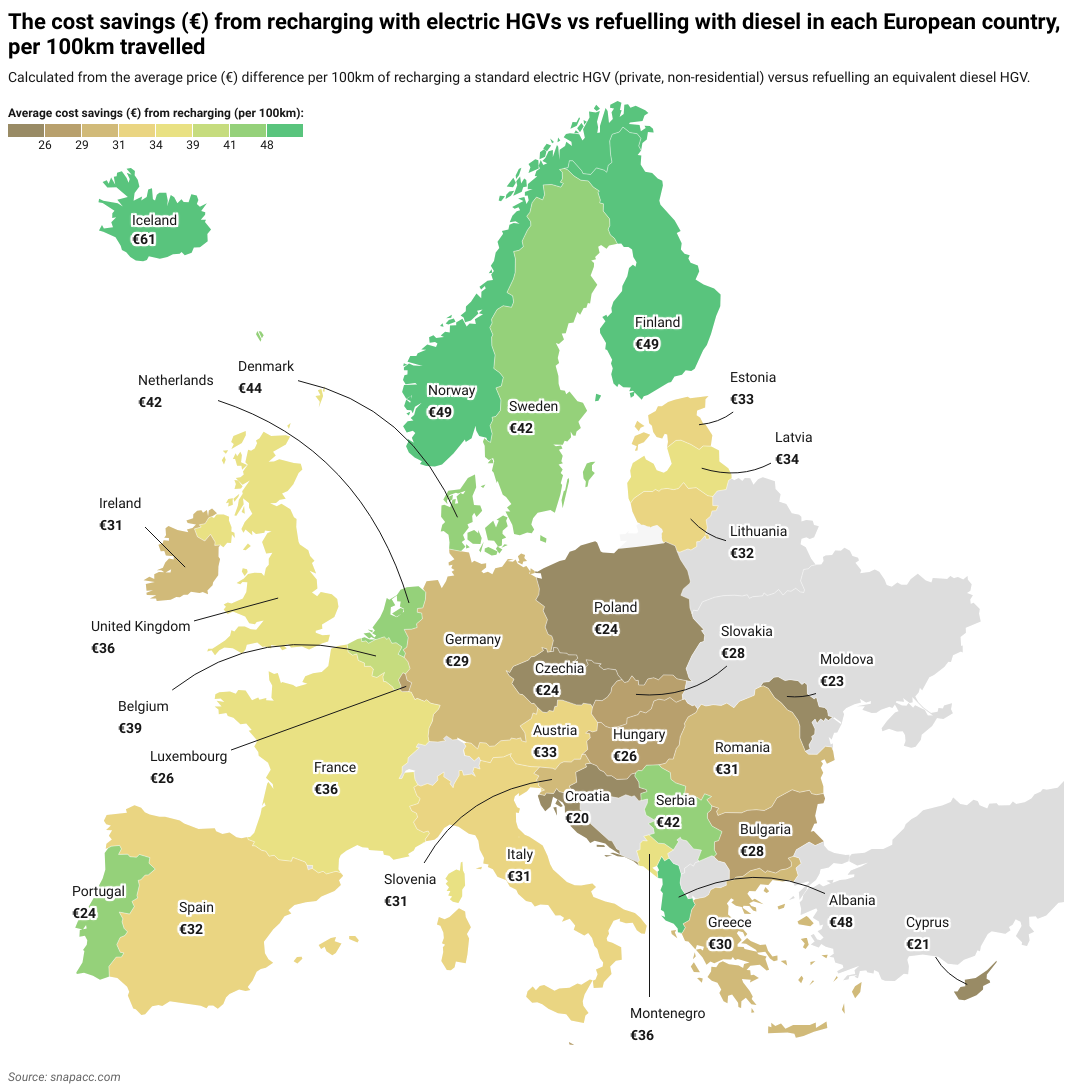

To assess the feasibility of fleet operators switching from diesel to electric, SNAP has authored research into the costs of recharging HGVs vs refuelling them across various European freight routes. We calculated the electricity versus diesel savings in euros per 100 km across 35 European countries.

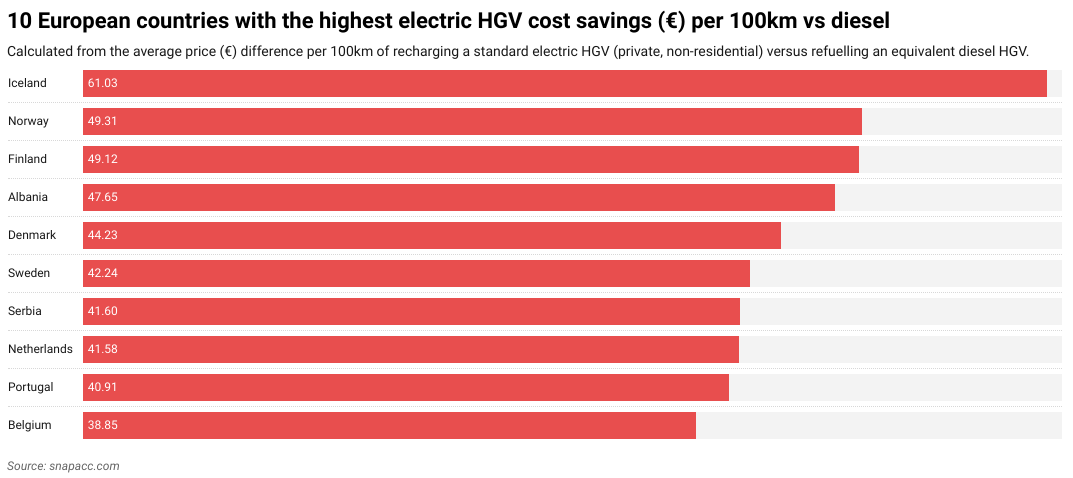

We found that Iceland led the way with an average cost saving of €61.03 per 100 km, with fellow Nordic countries Norway and Finland offering the second and third highest cost savings respectively. At the other end of the scale, Croatia offered the least amount of cost savings with €19.96 per 100 km, followed by Cyprus and Moldova.

In this article, we uncover the cost savings per European country and analyses some of the cost savings per European country and analyses some of the external factors that may be influencing these savings. We also dive into what the future of eHGVs in Europe may look like as well as how eHGVs can help fleet operators and drivers save money, particularly with driver budgets.

How the eHGV and diesel costs stack up across the EU

Our research found that for every European country investigated, using an eHGV with electric charging saved money when compared to using a traditional HGV with fuel. The primary difference was just how much the cost savings varied. For example, the price for electricity in the most expensive country, Iceland is 206% higher (41 euros higher) than the least expensive country, Croatia.

We found that on average, a driver with an electric HGV will save €30.59 per 100 km when compared with a diesel HGV driver. This translates to an estimated average saving of €37,200 a year for long-haul electric HGV drivers and €24,800 for domestic drivers.

To compile our data, we looked at 35 European countries and compared the energy or fuel cost per 100 km for two types of heavy goods vehicles (HGVs). These were a standard diesel HGV, assuming fuel consumption of 35 litres per 100 km at each country's average retail diesel price, and an electric HGV, assuming electricity use of 108 kWh per 100 km based on the average non-household electricity rate. VAT and recoverable taxes were excluded from these calculations. The comparison reflects direct “at-the-pump” or “at-the-plug” costs only, without accounting for factors such as fleet size, negotiated energy contracts, or future changes in fuel and electricity prices.

When researching the pricing for diesel and electricity, a number of sources were drawn from, including Eurostat, CEIC, GlobalPetrolPrices, Webfleet, and Gov.uk. It is worth noting that some of these sources refer to ‘Great Britain’ while others refer to the ‘UK’. For the purposes of this research, both terms were treated interchangeably.

Countries saving the most by converting to electric HGVs

Iceland (€61.03), Norway (€49.31), and Finland (€49.12) are currently the countries where the most can be saved by converting to an electric HGV.

This is largely due to these countries ranking among the most expensive in Europe for diesel. Iceland ranks as the most expensive country in Europe for diesel (€2.07 per litre). This steep cost largely comes from its geographical isolation compared with the rest of Europe, leaving the cost of importing diesel much higher than that of other European nations. Iceland, like Norway and Finland, is also known for its high tax rate, which also contributes to its high fuel cost.

Norway (32%) and Iceland (18%) also make up the top two countries in the world for electric cars on the road as a share of passenger cars on the road. As a result, both countries have invested significantly in electric charging infrastructure.

Iceland’s small size and main ring road also make it easier to install electric charging stations at regular intervals for electric HGV drivers. The same reasoning can be partly used for other countries with smaller networks that have a high rate of cost savings, including Albania, Serbia, and Belgium — although it should be noted that all three also have some of the most expensive diesel prices in Europe, which contributes to the difference in cost savings.

The chart below shows the top 10 countries that have the largest cost savings when using an electric HGV:

“Drivers across Europe are already saving by switching to electric HGVs. Switching to eHGV charging is the future of the industry and SNAP is ready to help drivers and fleet operators in the transition.”

Matthew Bellamy - Managing Director at SNAP

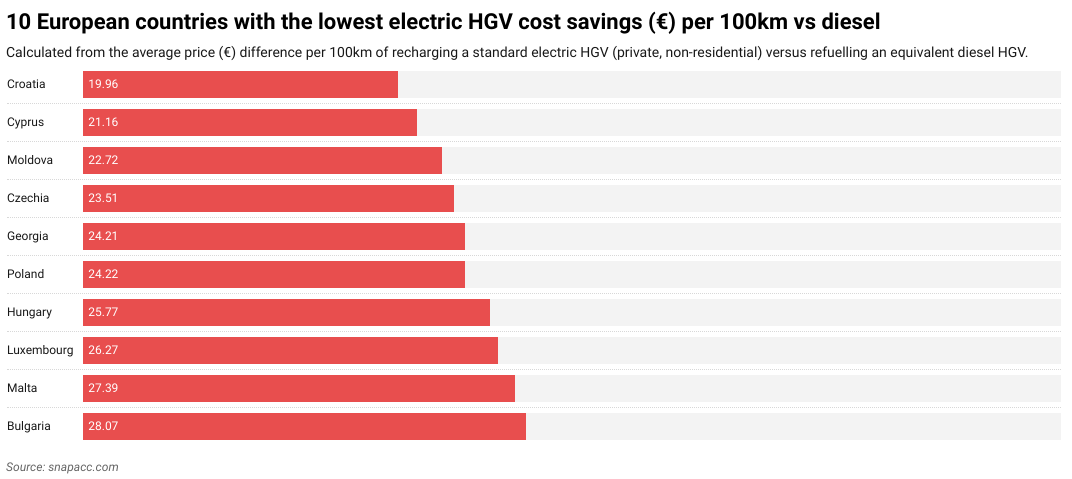

Countries saving the least by converting to electric HGVs

Croatia (€19.96), Cyprus (€21.16), and Moldova (€22.72) are currently the three countries with the lowest cost savings in Europe.

Croatia has the second slowest EV adoption rate in the EU after Poland. This is partly because of Croatia's poor EV charging infrastructure, such as charging stations that require ringing customer service or use multiple different apps to start the charging process, poor directions for charging stations outside major highways, and potentially high wait times during peak tourist season. Additionally, Croatia lacks ultra-high-speed charging stations (180 kW and above), which can prove a problem for electric HGVs that require more power than the average EV.

Both Cyprus and Moldova have internal geopolitical issues that make infrastructure planning for EV charging (as well as national planning in general) difficult. For Cyprus, the northern half of the island — including half of its capital, Nicosia — has been occupied by the Turkish-backed Turkish Republic of Northern Cyprus since 1974. For Moldova, the eastern province of Transnistria acts as a de facto state with its own government. This means that both countries are unable to implement EV infrastructure in a consistent way across the territory they consider their own.

The issues in Cyprus are also compounded by high electricity costs, while Moldova has the fifth cheapest diesel prices in Europe. Moldova is also the second poorest country in Europe, making investment in EV infrastructure a challenge. All these factors contribute to an overall low cost saving for electric HGVs.

Poland is also low on the list with a cost saving of €24.22. Despite its impressive economic growth and growing investment in EV charging infrastructure, its large size means that coverage is still an issue in certain areas of the country — although this looks likely to change in the future.

Countries such as Spain (€32.20), Romania (€30.62), and Ireland (€30.54) occupy the middle of the road when it comes to cost saving for electric HGVs. This is likely due to these countries have growing EV charging infrastructure, and mid-priced electricity and diesel costs.

The chart below shows the top 10 countries that have the lowest cost savings when using an electric HGV:

UK’s electric HGV cost savings

The UK has an eHGV cost saving of €36.23, which places it 11th overall for cost savings from recharging per 100 km. This is largely due to how expensive UK fuel prices are, with diesel prices being the third most expensive in Europe. Although the savings from high diesel costs certainly contribute to the UK’s high eHGV costs savings, it would likely be far higher if the electricity in the UK were not also amongst the most expensive in Europe.

The UK is also expecting improvements to its EV charging infrastructure. The UK motorway service company, Moto is actively planning to build 15 ‘superhubs’ by 2027. These superhubs can better accommodate EV charging for eHGVs more efficiently than a standard EV charger. There are currently fewer than five eHGV-dedicated charging points on UK roads. With other companies like BP Pulse and Aegis Energy also looking to invest, it looks likely that the UK will have a much-improved HGV charging network in the near future.

What is impacting HGV electrification?

There are several factors currently impacting HGV electrification, including a lack of charging infrastructure, long charge times, the high initial costs of eHGV conversion, and their limited range. Additionally, the comparatively low cost and accessibility of diesel fuel and vehicles make traditional HGVs an attractive option for fleet operators.

However, all these impacts can vary depending on the country of operation. For example, if your fleet only runs domestically in a country such as Norway or Iceland, then it is likely to be less affected than a fleet operating across Europe or in regions with poorer eHGV infrastructure, such as the Balkans.

Insufficient charging infrastructure

The main obstacle to HGV electrification is insufficient eHGV charging infrastructure. This is because eHGVs require megawatt-scale charging, which most existing EV charging points for passenger vehicles (standard electric cars and vans) do not support.

There are many countries in Europe that severely lack such infrastructure, especially on major freight routes and at truck stops. These tend to be poorer states in southern and eastern Europe such as Moldova, Georgia, and Bulgaria. It is no coincidence that these states rank in the bottom 10 for eHGV cost savings.

It can also be the case that eHGV charging stations do exist, but they are in areas that simply can’t accommodate multiple eHGVs charging overnight due to a weak local power grid. This is often a problem in more rural and remote parts of Europe.

Although many European countries are planning to improve eHGV infrastructure, it is still a time-consuming and expensive process, with numerous bureaucratic, logistical, and technical obstacles to overcome — not to mention the surrounding infrastructure upgrades, such as local grid connections, that will also be needed.

Long charging times

Electric HGVs take far longer to charge than standard EVs. This means that charging must often take place overnight. Even if rapid eHGV chargers can be acquired, the process still takes at least two hours, rather than a few minutes, as is the case with petrol vehicles.

This long charging time can have a knock-on effect for fleet operators in terms of turnaround times. In an industry with tight delivery schedules and deadlines, this can be potentially detrimental to business performance.

Limited range of eHGVs

Electric HGVs are also constricted by their relatively limited range compared to the mileage afforded by traditional HGVs. According to Safety Shield, a typical electric HGV has a range of around 300 miles on a single charge (roughly the distance from London to Rotterdam). A typical diesel-powered HGV, however, can travel up to 1,000 miles on a single tank of fuel (roughly the distance from London to Warsaw).

Electric HGV mileage can also be more affected by external factors such as load, cold weather, and terrain. This can lead to range anxiety for drivers, who may conduct more frequent charges to ensure they have enough power to reach their destination. This, in turn, can lead to delivery delays, especially when driving through countries with poor eHGV charging infrastructure.

All of this makes it route optimisation vital for fleet operators planning journeys for their eHGVs. It should be noted that battery technology is constantly evolving, and capacity — and therefore mileage — will continue to improve in the near future.

High eHGV costs

The initial cost of an eHGV is high (typically between £160,000-£200,000, compared to between £80,000-£100,000 for a diesel HGV) which can potentially deter independent drivers and smaller fleet operators from owing one. This is largely due to the expense of the battery technology involved. This means that it will be costly to purchase a new electric HGV outright as the technology inside is more expensive than that of a diesel HGV.

High initial eHGV purchasing costs also means that fleet operators in countries with cheaper electricity rates for eHGV charging such as Norway, Sweden, or Finland are more likely to convert since they will recoup their investment quicker than those in countries with expensive electricity, such as Ireland and Croatia.

Electricity prices can also fluctuate in relation to various events. For example, over the past five years, electricity prices have fluctuated in response to economies opening up after the COVID-19 pandemic and then Russia's invasion of Ukraine in 2022 (the latter in particular had major effects on European energy supply). As a result, there was a spike in electricity prices of almost 30%, from 20.5 c€/kWh, to 26.5 c€/kWh for the average EU capital in the post-invasion period. With the EU average now, however, lower than it was in 2022, it appears that electric charging for HGVs is set to continue its ascendency.

Across Europe, the average cost of running an electric HGV over 100 km is €20.51 — significantly cheaper than the €51.10 it costs for a diesel HGV over the same distance.

As efficiency improves and battery technology becomes more widespread and less expensive to produce, eHGVs will also become more affordable to acquire.

Cheapness and accessibility of diesel fuel

Diesel fuel still plays a dominant role in the HGV industry. This is because diesel infrastructure has been well established in Europe for decades, especially in comparison to electric chargers for HGVs. Diesel's compatibility with fuel cards, and its relatively cheapness also keep it popular with truck fleet managers.

As with electricity, however, the value of diesel fluctuates across the continent. This is why it can appear more advantageous to stick with diesel HGVs in countries like Moldova, Georgia, and Malta, where diesel remains cheap. Conversely, for nations like Iceland and the Netherlands, where diesel is relatively expensive, there is greater incentive to switch to an electric HGV.

A country with low-cost fuel may also be more hesitant to invest heavily in eHGV infrastructure for fear of alienating traditional HGV fleets, who may choose alternative routes as a result.

The future of electric HGVs in Europe

Electric HGVs are the long-term future of road haulage. Not only are they cheaper to run over time, but with new infrastructure being invested in and built at a strong rate, they will also become much more financially and strategically viable.

Beyond the economic benefits, electric HGVs are also important for their contribution to environmental goals such as Net Zero. With traditional HGVs being large-scale polluters, the emissions saved by eHGVs will be felt in cleaner air across Europe.

The following trends look set to impact electric HGVs in the future:

- Smart truck parks: Truck parks in the future will evolve to better accommodate eHGVs alongside other smart technological advancements. These truck parks may include up-to-date ultra-fast charging stations, diagnostic machines, battery swap stations, and automated cleaning services, among other features.

- Increased EU regulations: Low Emission Zones (LEZs) already exist in a number of cities (e.g. Paris, Berlin, and Milan) with more European cities likely to follow suit with more stringent EU transport regulations. Fleet operators may opt for eHGVs to meet EU regulations or retrofit their HGVs with cleaner technologies, like smart tachographs.

- AI implementation: AI technology has already had a profound sustainability impact across road haulage — with applications in route optimisation, predictive maintenance, and autonomous vehicle development. Electric vehicles will likely incorporate AI to help drive sustainability in the haulage industry over the coming decades.

- Sustainability: The shift to eHGVs is part of a wider global push toward sustainable living. The effects of extreme weather, including heatwaves and floods across Europe, show no sign of slowing due to climate change. Moving to electric HGVs is one way the world is reducing its dependence on fossil fuels.

- Fuel variety: During the transition to cleaner fuel sources, there will be a variety of HGV types on the road throughout the 2030s. Many will be older diesel models, some will be electric, and others will be powered by alternative fuels such as biofuel made from renewable biomass sources.

Manage eHGV costs smarter

Electric HGVs are the future, of that there is little doubt. The economic and environmental benefits will see more fleet operators and drivers switch to eHGVs in the coming years. How long this transitional period lasts will depend on how quickly Europe can develop its eHGV charging infrastructure.

There are currently large swathes of the continent where eHGVs lack viability and require extensive route optimisation due to their shorter range. Additionally, the upfront costs involved can deter independent drivers and smaller fleet operators.

The technology and infrastructure will continue to improve, and there are already services designed to make managing eHGV fleets and related costs as simple as possible. From route optimisation and fleet management to maps for parking and truck washes, SNAP makes trucking simple.